1099 Transaction Detail Report Quickbooks Online

First select button 1 to see what boxes are being used on the 1099 Detail Transaction Report. Then go to the Vendors option.

How To Export A 1099 Transaction Detail Report From Quickbooks Online Asap Help Center

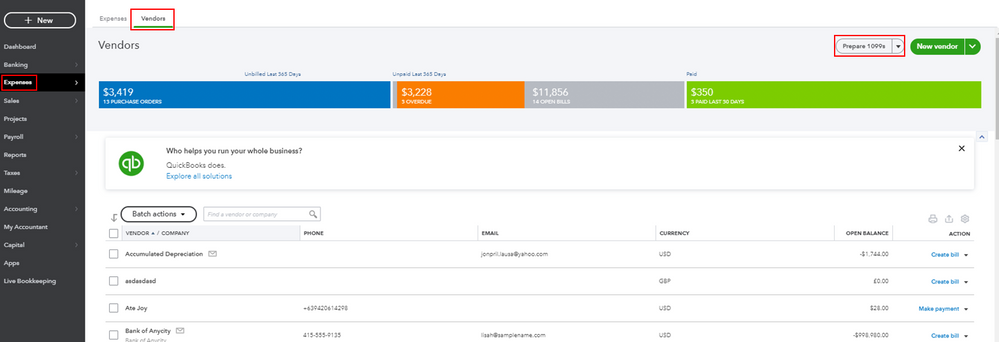

1 Select Expenses then Vendors.

. Open Purchase Order List. QuickBooks Online Steps to view excluded ePayments to vendors. From the Expenses menu select Vendors.

However when I generate the report no vendors show up. To run the report. Scrutinizing Vendor Payments for 1099 Eligibility in QuickBooks.

Now the contractor is set up correctly and QuickBooks will start tracking the payments made to this contractor. Select the Report Period. After that you have to choose Prepare 1099s.

Mike with Parkway shares his QuickBooks workaround to track 1099 vendors. You can select the total in this column to see an Excluded Payments by Vendor report which shows transaction. Lets go through the process of setting up the 1099 preferences.

Select Export to Excel 7. Select the date you want to run the report. To help with end-of-year filings run a report of all the payments you made this year to your 1099 vendors.

Choose 1099 Wizard then select Get Started. Vendor Settings for 1099 Eligible Tracking in QuickBooks Desktop. Click on the Filter icon and select Transaction Type.

Open Purchase Order Detail. Overview of 1099-NEC for Nonemployee Compensation. First select Contractors from the Payroll menu.

QuickBooks ignores those types of names when figuring out what 1099s to prepare. Click on the Prepare 1099s. The trick here is to examine your recap.

Im using QuickBooks Online and trying to generate a 1099 Transaction Detail Report. The first time you run this report you will receive a blank page. Purchases by Location Detail.

How to Export a 1099 Transaction Detail Report from QuickBooks Online. Similarly when I try to use QuickBooks service for filing 1099 no vendors show up. Click on the Workers tab then select Contractors.

I have already gone to each of the vendors Id like to track and checked the Track payments for 1099 box. Click on the drop-down then choose Payments. These steps walk you through organizing your contractors and payments so your filings are correct.

Choosing Accounts for 1099 Tracking and Reports. Review Check that the payments add up. Yes you can prepare your 1099s before running the 1099 Transaction Detail Report in QuickBooks Online Payroll.

To export your data from QuickBooks Online. If you want to generate 1099 through QuickBooks Online follow the steps outlined below. Ive seen several occasions where a vendor was listed as an employee or maybe even a customer.

Process 1099s with QuickBooks Desktop or Online. The job cost report in QuickBooks Online is referred to as Time cost by employee or supplier. From QuickBooks Online navigate to the Expenses tab and the Vendors section.

From this page choose the green box that reads Continue your 1099s. Go to the drop-down in the Apply payments to this 1099 box section. In 2020 the Internal Revenue Service introduced a new form 1099-NEC to report Non-Employee compensation.

Click on the Prepare 1099s. Click on the box at the top of the screen that says Prepare 1099s. To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online.

The first time you run this report you will receive a blank page. Purchases by Class Detail. Heres how to get your 1099s ready to e-file or print.

You can access the mapping database by using the buttons labelled 123 below the recap list. Click Run Report 5. Click the Export Icon 6.

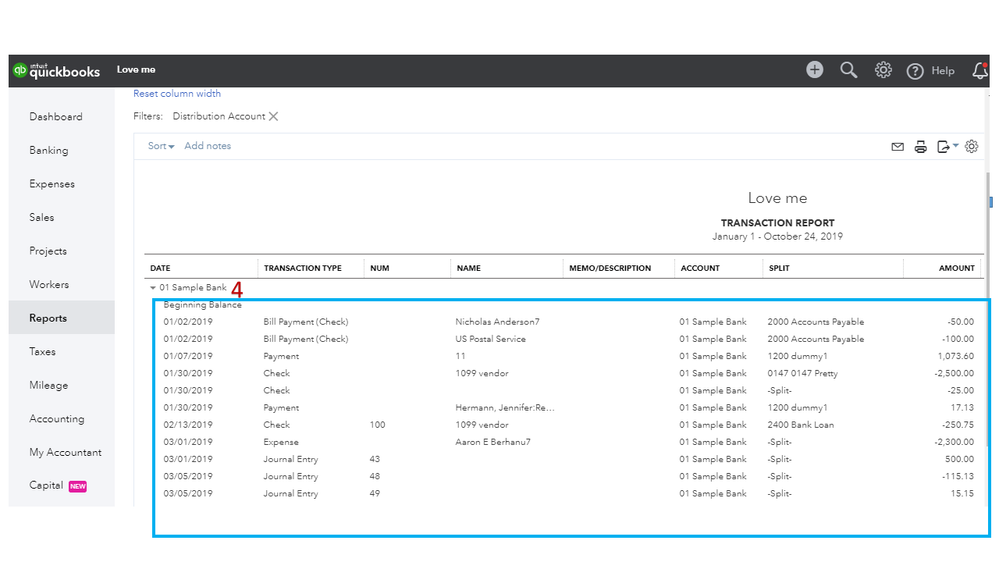

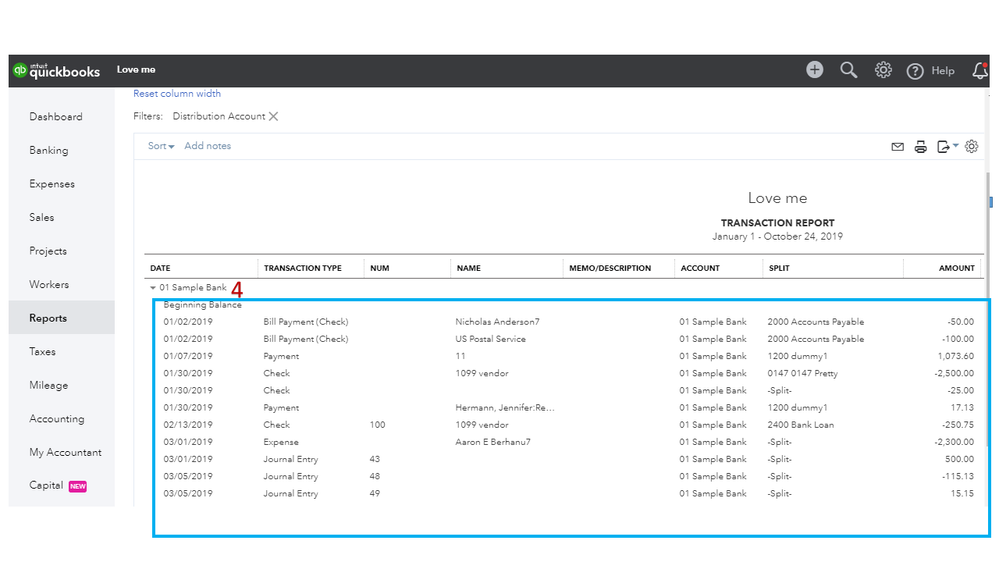

My recommendation is to run the transaction detail for the entire year by Name. Verify the vendor information is correct. The new 1099 Transaction Detail Report is available in QB Online Essentials but it also requires the vendors transaction accounts to be selected as well.

Go to Reports at the top menu bar then select Transaction List by Customer. Click Reports from the left side menu. ASAP 1099 Processing Services FAQs.

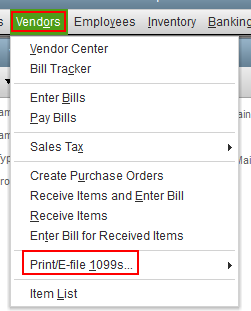

Go to Vendors and select PrintE-file 1099s. Click 1099 Transcation Detail Report 3. Select vendors that need form 1099-MISC and select Continue.

2 Select Prepare 1099s. 1099 Transaction Detail Report. If you do not see any totals then the mapping of data in the 1099 Detail Transaction Report has not been completed.

Once Done select Let us. How to prepare and file 1099s with QuickBooks Desktop. Lets go through the process of setting up the 1099 preferences.

Or you can also click Expenses. Sales Tax QuickBooks Sales Tax Reports will give you information about your. On the QBO website choose the Expenses tab and click on Vendors in the dropdown menu.

3 Go to the Preview 1099 and 1096 Information section and note the column titled Total 1099 Payments Excluded. If ASAP is processing your 1099s please upload the reports in Excel format to us by using. Click on the Workers tab then select Contractors.

Go to the Payroll menu then select Contractors. Click Save and Select Save As to save the excel 1099 Transaction. To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online.

Details related to 1099 changes implemented by the Internal Revenue Service IRS can be viewed via Tax Year 2020 Instructions for Forms 1099-MISC and 1099-NEC. 1099 Transactions detail report. Both the 1099 Summary Report and 1099 Details Report can be exported into an Excel file.

For Type of Contractors select 1099 contractors that meet threshold For Payment Type select Included in 1099 Select This Year for the Report period. Select OK on the bottom to save. Verify that all of your company information is correct and choose Next.

1099 Detail -The 1099 Detail Report will tell you what transactions make up the amounts that need to be reported for each vendor that receives a 1099-MISC. Then scan through there to make sure you arent missing any names on the vendor. The report youre looking for is on Step 4.

Select the Tax Settings tab on the left side and fill in the Vendors Tax ID or SSN if an individual this will be on the completed form W-9 and check the box next to Vendor eligible for 1099. In order to accomplish this see below. 1099 Data Preview File for Payments Issued via Payroll.

Select Lets get started or Continue your 1099s. Follow the steps to prepare 1099s.

How Do I View A Transaction Detail Report With An Opening And Closing Balance

How To Export A 1099 Transaction Detail Report From Quickbooks Online Asap Help Center

No comments for "1099 Transaction Detail Report Quickbooks Online"

Post a Comment